as mentioned in

Why I Bought Intel On The Mobileye Acquisition News - Intel Corporation (NASDAQ:INTC)

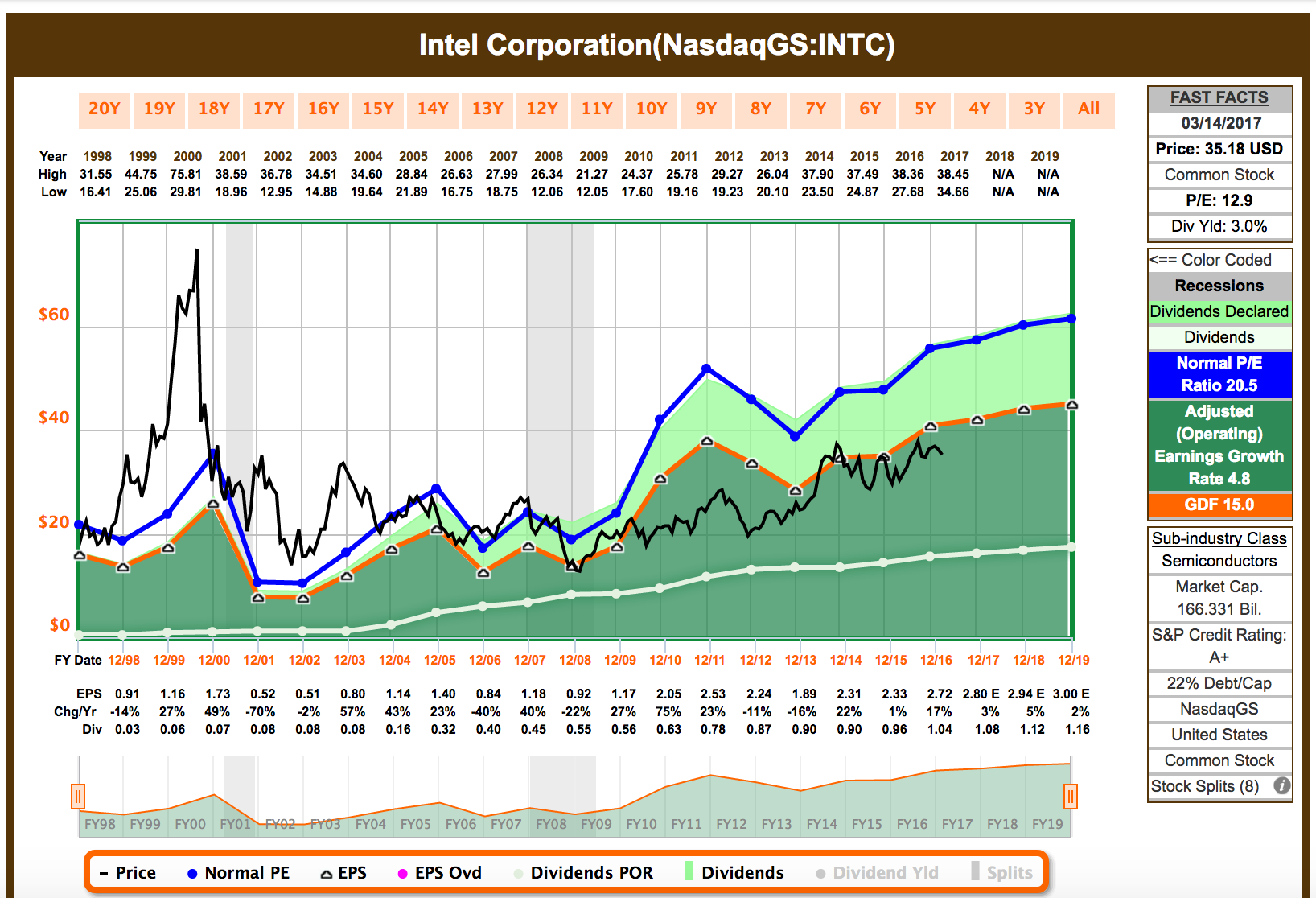

As a dividend growth investor, I focused a lot of my attention on shareholder returns throughout the markets. Right now, INTC facebook/" target="_blank">shares are trading down nearly 9% from 52-week highs set in late January of this year. INTC shares are down 3.01% YTD, but they are up nearly 19% from 52-week lows set back in May of 2016. Well, in the case of Intel (NASDAQ:INTC) and news of its recent bid for Mobileye (NYSE:MBLY), the market frowned upon the move. I hadn't added to INTC for years due to its unpredictable dividend growth pattern and low top-line growth expectations.

Miles = data," wrote Morgan Stanley analyst Adam Jonas in a note on Monday to clients after Intel announced the deal. Self-driving car data could bring in $450-$750 billion globally by 2030, according to McKinsey & Company, with such wide-reaching applications as shopping inside cars, vehicles as entertainment centers, or better city planning based on data. One issue still to be hammered out is who owns the data a self-driving car collects and whether the passenger has a privacy right. That data, says Intel Corp Chief Executive Brian Krzanich, is the key to the deal, and may see its first tangible revenue stream through mapping technology. It is also too early to gauge whether Mobileye will win a data race that has barely begun.

read more visit us industry

collected by :John Max